how to declare mileage on taxes

Ad Enter Your Tax Information. Multiply the standard mileage rate by your total miles driven or determine your actual expenses for the year including mileage depreciation of your car and other costs.

Self Employed Mileage Deduction Guide Triplog

This rate fluctuates yearly and applies to vehicles including cars trucks and vans.

. There are two ways to calculate mileage reimbursement. Reimbursement typically takes the form of a certain dollar amount for each mile driven on company business. See What Credits and Deductions Apply to You.

For the vehicle reimbursement to be. The following table summarizes the optional standard mileage rates for employees self-employed individuals or other taxpayers to use in computing the deductible costs of operating an automobile for business charitable medical or moving expense purposes. The detail of your expenses will be shown on either Form 2106 or 2106-EZ which is used to report employee business expenses.

The mileage tax deduction is calculated by multiplying qualified mileage by the annual rate set by the Internal Revenue Service. There are two ways to claim the mileage tax deduction when driving for Uber Lyft or a food delivery service. If youre self-employed or an independent contractor however you can deduct mileage used solely for business purposes as a business-related expense.

For example to keep track of gas maintenance insurance fees etc. For small businesses an accurate mileages log can produce significant tax savings through mileage deductions. The standard IRS mileage rate for the 2021 tax year is 056miles.

535 cents per business mile 17 cents per mile for medical miles moving miles When completing your tax returns youll list the total amount of miles driven on form 2106 line 12. For qualifying trips for medical appointments the rate is 016mile. Enter your mileage expense by completing form 2106 employee business expenses.

If the mileage rate exceeds the IRS rate the difference is considered taxable income. How to deduct mileage for taxes for the self employed. Check e-file status refund tracker.

The hardest way to track your mileageand the way the IRS would like you to do itis to keep track of every mile you drive every day 52 weeks a year using a mileage logbook or business diary. Multiply that number by the standard mileage rate for 2021. In reality companies using this rate will over-reimburse some employees and under-reimburse others.

Dont Know How To Start Filing Your Taxes. Prepare federal and state income taxes online. E-File your tax return directly to the IRS.

Rates in cents per mile. Tax Tools and Tips. Multiply your business miles driven by the standard rate 56 cents in 2021.

But this assumes that other rules are being followed to make the reimbursement part of an accountable plan. For example if your only miscellaneous deduction is 5000 of mileage expenses in a year you report an AGI of 50000 you must reduce the deduction by 1000 50000 times two percent. The standard mileage rate for 2021 taxes is 56 cents per mile driven for business 585 cents per mile for 2022.

Improving gas mileage and growing sales of electric vehicles have prompted a national search for. Some may argue that using the IRS rate for all employees creates a uniform method of reimbursement. Drawbacks of the IRS Rate for Mileage Reimbursement.

If you used your car for a business that you own you would claim your standard mileage deduction on Schedule C of IRS Form 1040. For the 2021 tax year the rates are. How do I deduct mileage on taxes.

How do I track business miles. The most important tax deduction for rideshare drivers is the mileage deduction since it will be your biggest driving expense. 56 cents per mile for business miles driven down 15 cents from 2020 16 cents per mile driven for medical or moving purposes down 1 cent from 2020 14 cents per mile driven in service to a charitable organization.

Take for example a Los Angeles California employee paying 650 a gallon for gas. This IRS mileage write off method requires you to itemize each vehicle expense for the year. Ad Our Experts Will Make You Confident Your Taxes Are Done Right Guaranteed.

Next click on Ill choose what I work on jump to full list Scroll down the screen until to come to the section Business Income and Expense. If you are an employee you cannot deduct gas mileage as an unreimbursed expense on your tax return. Standard Mileage Rate most common The Standard Mileage Rate is most convenient.

For volunteer work the rate is 014mile. To deduct business miles for self-employed in TurboTax Online or Desktop please follow these steps. Annually the IRS annually specifies a per mile rate for this method.

You would figure your standard mileage rate deduction on IRS Form 2106 and report this amount on Schedule A of IRS Form 1040. Rates per business mile. Tax calculators.

A mileage reimbursement is not taxable as long as it does not exceed the IRS mileage rate the 2022 rate is 585 cents per business mile. Business expenses for employees are generally non-deductible as of the Tax Cuts and Jobs Act of 2017 TCJA. The answer is it depends.

Once you are in your tax return click on the Business tab. Connect With An Expert For Unlimited Advice. Your employee travels 12000 business miles in their car - the approved amount for the year would be 5000 10000 x 45p.

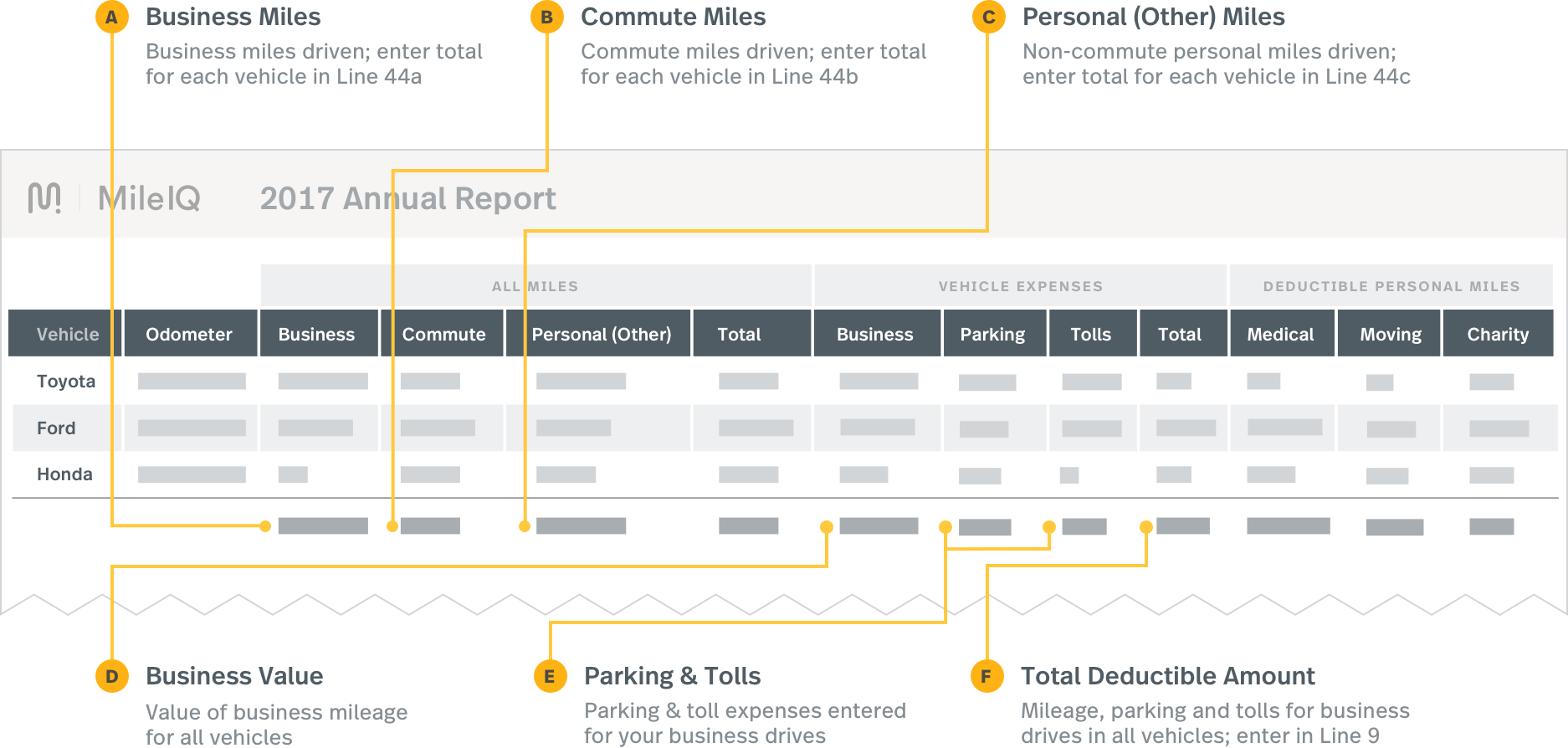

Gathering their mileage report from MileIQ. Typically the reimbursement stays non-taxable as long as the mileage rate used for reimbursement does not exceed the IRS standard business rate 0625mile for 2022. All tax tips and videos.

What Business Mileage Is Tax Deductible

Self Employed Mileage Deduction Guide Triplog

Mileage Tax Deduction Claim Or Take The Standard Deduction

:max_bytes(150000):strip_icc()/Calculating_Mileage_for_Taxes_GettyImages-88327427-f6e3ca37a370470f9c3958ab60cf19dd.jpg)

Standard Mileage Rate Definition

Free Mileage Reimbursement Form 2022 Irs Rates Pdf Word Eforms

Mileage Vs Actual Expenses Which Method Is Best For Me

.png)

Mileage Vs Actual Expenses Which Method Is Best For Me

:max_bytes(150000):strip_icc()/ScreenShot2021-02-06at6.37.24PM-e6ebd594161f4e2dba070ffdf962076c.png)

Form 2106 Employee Business Expenses Definition

How To Claim Mileage And Business Car Expenses On Taxes

Self Employed Mileage Deduction Rules Your Guide To Deducting Mileage

Business Mileage Deduction 101 How To Calculate Mileage For Taxes

Free Mileage Log Template For Excel Everlance

What Are The Mileage Deduction Rules H R Block

Business Mileage Deduction 101 How To Calculate Mileage For Taxes

Reporting Mileiq Mileage With Tax Software Mileiq

How Do Food Delivery Couriers Pay Taxes Get It Back

Business Mileage Deduction 101 How To Calculate Mileage For Taxes

Federal Tax Laws On Mileage Reimbursement Turbotax Tax Tips Videos